Key Factors in Choosing a Safe Deposit Centre Partner

Successful entrepreneurs rarely work alone. Some of the secret of their success lies in appreciating that it pays to partner with the right people,...

4 min read

Emmanuel Harir Forouch

:

Jun 9, 2021 11:00:00 AM

Emmanuel Harir Forouch

:

Jun 9, 2021 11:00:00 AM

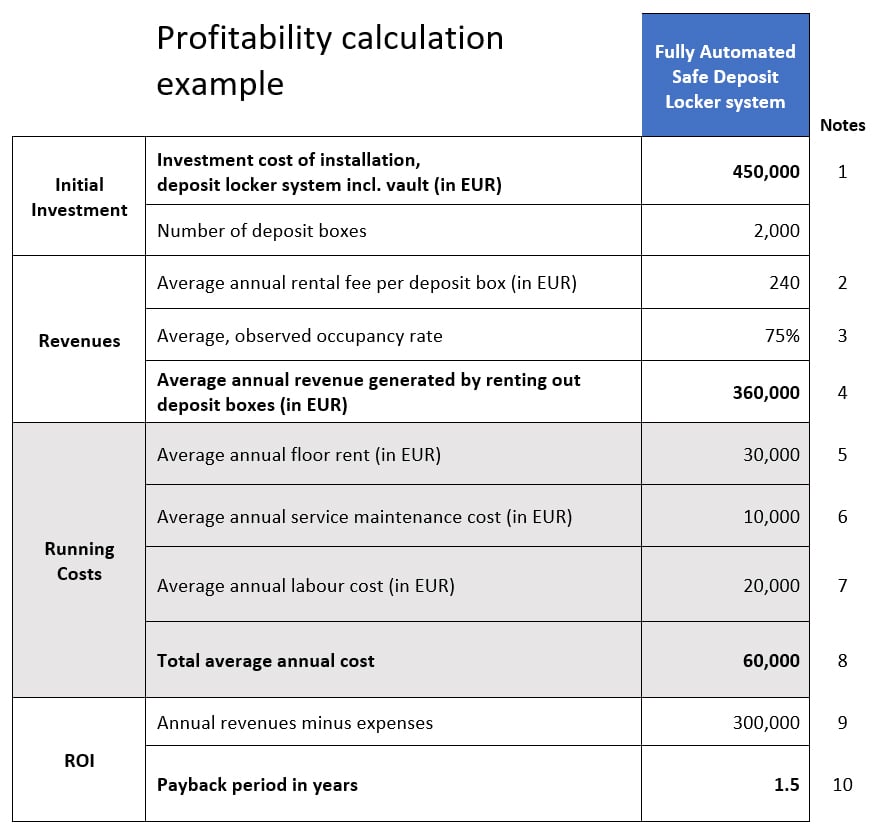

What is the most important consideration before making an investment? It is probably how quickly you are going to get your money back and then start making a profit. Nobody is interested in investing in something unless it is going to generate a profit, so this is undoubtedly the one overriding concern that could sway an investor’s decision either way.

When exploring investment opportunities, it is critical to know the payback period. This blog gives you a calculation example of actual figures from an existing installation and the projected investment return.

Having always been a service offered by financial providers, the demise of the bank branch is a strong factor in the reduction of the current availability of this service.

Leading Global Management Consultants, Kearney, predict that 25% of bank branches will close across Europe in the next three years as customers favour digital banking. This is a sharp increase in the ongoing trend of the shutdown of bank branches across Europe, which saw 35% percent of them close over the last ten years.

Customer demand for secure, flexible safe storage away from their home will increase further as branch numbers decrease - those that have valuables will need to re-site them, those that newly acquire tangible assets etc will have less choice. This has resulted in a great opportunity to fulfil the increasing demand for safe deposit box facilities.

Why are automated safe deposit lockers an attractive investment opportunity?

Due to the increasing demand described above, the provision of self-service, safe deposit locker facilities, is an attractive investment opportunity. In the past, the service mainly provided by banks required staff escort to access the customer safe deposit lockers. The latest technology offers fully automated solutions that can be accessed by the customers themselves, at any time. The added beauty of such an automated solution is that it is also a familiar, user friendly self-service terminal concept with high customer acceptance and thus one potential obstacle is already overcome.

By combining next-generation automated technology and advanced customer identification features, service providers can offer their customers 24/7 accessibility and still uphold the highest levels of security.

Gunnebo’s most modern, fully automated safe deposit locker solutions offer the following features:

See how it works in our short YouTube video:

Although the primary investment for a fully automated safe deposit locker solution may initially appear high, the profitability potential to secure both a good ROI and a fast payback period are exceptionally promising and decidedly achievable in a considerably shorter time frame than many other investments.

The following business case example is based on a real-life scenario. Project scope and calculations are explained in the notes below.

Notes:

With a higher occupancy rate and being able to command an elevated rental rate in premium locations or for larger lockers, this calculation will provide an even quicker return on investment.

Furthermore, if the location is owned or already fully depreciated rather than the space leased, the rental cost is negated in the above calculation

In recent years, the “self-service” concept has been applied to many services and solutions across all industries. In today’s 24-hour, high-tech society, customers expect to be provided with instant access to services and the precious items stored within them whenever they want. No longer being constrained by financial institution opening hours, customers are prepared to pay for the flexibility afforded by unrestricted and convenient access to their deposit box.

The above example shows that Gunnebo Safe Storage can provide you with a solid business case and evidential proof in the form of real examples of successful ventures to prove the profitability potential from a strategically funded project.

We appreciate that the profit element is probably the most attractive component of any commercial justification, but it is certainly not the whole picture. If this article has piqued your interest sufficiently, then please download our free investor guide entitled ‘’Why are automated safe deposit lockers an attractive investment opportunity? A guide for private investors’, where you will find a comprehensive description of the various criteria for a profitable investment, the current market conditions and environmental forces, as well as a presentation of a full business case.

.jpg)

Successful entrepreneurs rarely work alone. Some of the secret of their success lies in appreciating that it pays to partner with the right people,...

There are so many factors that can affect the success of an investment. A thorough appreciation and understanding of the commercial conditions...

3 min read

Last week we read of a new investment scandal in Cologne, Germany where investors entrusted an unknown company with 45 million Euros to buy gold and,...