How quickly will a safe deposit locker centre give a good ROI?

What is the most important consideration before making an investment? It is probably how quickly you are going to get your money back and then start...

2 min read

Emmanuel Harir Forouch

:

Jun 16, 2021 11:00:00 AM

Emmanuel Harir Forouch

:

Jun 16, 2021 11:00:00 AM

.jpg)

Successful entrepreneurs rarely work alone. Some of the secret of their success lies in appreciating that it pays to partner with the right people, with the exact experience, knowledge, expertise and vision that they need, when they need to. Those with great business acumen recognise that strategic goals are achieved far faster and more efficiently when experts are appointed, and partnerships formed. That is especially valid when it comes to investments in solutions for safe storage of valuables, like automated safe deposit locker centres.

The following blog looks at some of the necessary credentials and key factors you should consider when selecting a solution provider for a major, highly secure safe storage solution.

Every investor will be different and will have their own set of criteria. Probably the easiest way to think about partnerships is to ask yourself, "Who has the capabilities, skillset and a track record of successfully established projects that I need, to move ahead with my investment plan?"

Always bear in mind what you are thinking about investing in and which suppliers have the necessary wherewithal, industry presence and quality reputation to realise your venture.

When choosing any partnership, however, there are other critical pre-requisites that you should consider. Here are just a few common factors that should be a part of the search criteria when evaluating a suitable partner to realise a safe storage investment project.

Why are automated safe deposit lockers an attractive investment opportunity?

First and foremost a partnership must be the right fit for both parties. It may be that there is an industry synergy with a collaboration, but above all, investors should expect the following from their chosen partner:

Having reviewed and addressed the presence of the necessary attributes, it is worth considering what differentiates one prospective partner from another. What else can they provide that others don’t? Are there additional benefits that can help diversify and fulfil customers’ needs better?

The following questions should be answered when forging a successful strategic partnership

A shrewd entrepreneur collaborates with other like-minded entrepreneurs in their network, multiplying their results and maximising the others’ experience, expertise and strengths.

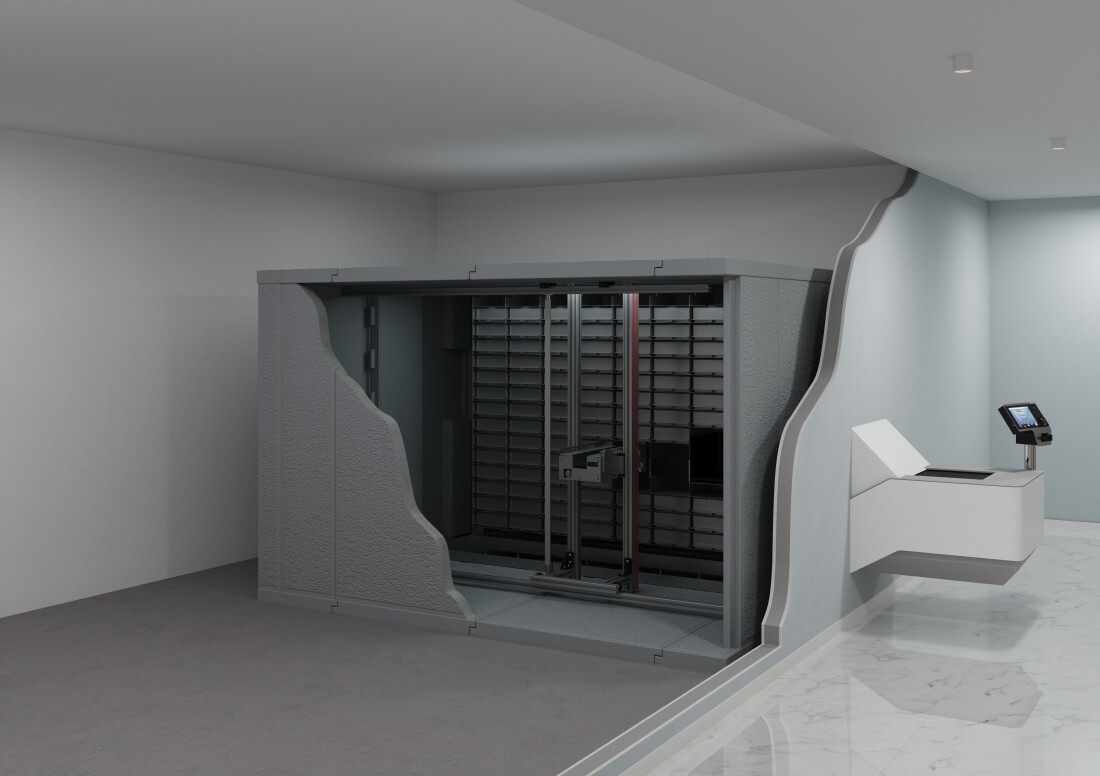

If you are interested in learning about the credentials of Gunnebo Safe Storage as a partner to help realise an investment project in the business of automated safe deposit lockers, then we suggest you download our complimentary investor guide entitled‘’Why are automated safe deposit lockers an attractive investment opportunity? A guide for private investors’

What is the most important consideration before making an investment? It is probably how quickly you are going to get your money back and then start...

Increasing demand for digitalisation and services available at all times is gradually transforming the relationship between banks and their...

As customer expectations around access, security and convenience evolve, so too must the technology behind secure storage. Gunnebo Safe Storage’s...